Momentus valuation slashed in revised SPAC deal

WASHINGTON — A special purpose acquisition corporation (SPAC) has revised its agreement to merge with in-space transportation company Momentus, cutting the value of the deal in half.

Stable Road Acquisition Corporation filed an amended registration statement with the U.S. Securities and Exchange Commission June 29, revising details of a merger with Momentus announced in October 2020. At the time, the companies said the merger would value Momentus at more than $1.1 billion once the deal closed.

In the revised agreement, Momentus will be valued at just $566.6 million, half the original value of the deal. Stable Road and other investors will take a larger stake in Momentus. Under the original agreement, Momentus’s existing owners would have owned between 71.4% and 78.2% of the merged company, with the rest owned by Stable Road and other investors participating in the deal. In the revised agreement, that ownership share drops to between 55.4% and 63.4%, depending on how many Stable Road shareholders redeem their shares.

The merger, originally expected to close in early 2021, has been delayed by several issues, including concerns that U.S. government agencies raised about Momentus’s foreign ownership. The company’s Russian co-founders, Mikhail Kokorich and Lev Khasis, sold their stakes in the company in June for $50 million, months after Kokorich stepped down as chief executive.

Momentus said June 9 it had reached a national security agreement with the Defense and Treasury Departments, outlining steps that it would take to address the national security risks the Defense Department previously raised. Besides the divestments by Kokorich and Khasis, the company agreed to take additional security measures and add to its board a director appointed by the Committee on Foreign Investment in the United States (CFIUS) charged with confirming compliance with terms of the agreement.

By then, however, Momentus had missed two opportunities to launch its first Vigoride tugs. The company dropped out of SpaceX’s Transporter-1 rideshare mission in January, saying that it could not get a Federal Aviation Administration payload review approved in time. In May, the FAA rejected a payload review for two Vigoride tugs that Momentus planned to launch on the SpaceX Transporter-2 rideshare mission, citing national security concerns.

In the registration statement, Stable Road said that the first Vigoride launch is not expected until June 2022. Momentus has suspended discussions with SpaceX for those Vigoride launches “while Momentus works to secure approvals from the U.S. government that are required for its missions,” with “the potential that such approvals may take longer than expected to obtain or may never be obtained.”

Momentus has also lost customers as a result of the deal. Stable Road said that Momentus’s backlog has dropped from $90 million in November 2020 to $66 million as of June 11. That was another factor Stable Road cited in the decision to renegotiate the deal.

The loss of customers and delayed introduction of its Vigoride tug has reduced financial projections for Momentus. In October, Momentus projected $12 million in revenue in 2021 and $104 million in 2022, growing rapidly to more than $4 billion by 2027. The latest projections forecast no revenue in 2021 and only $5 million in 2022, increasing to just under $2.2 billion in 2027.

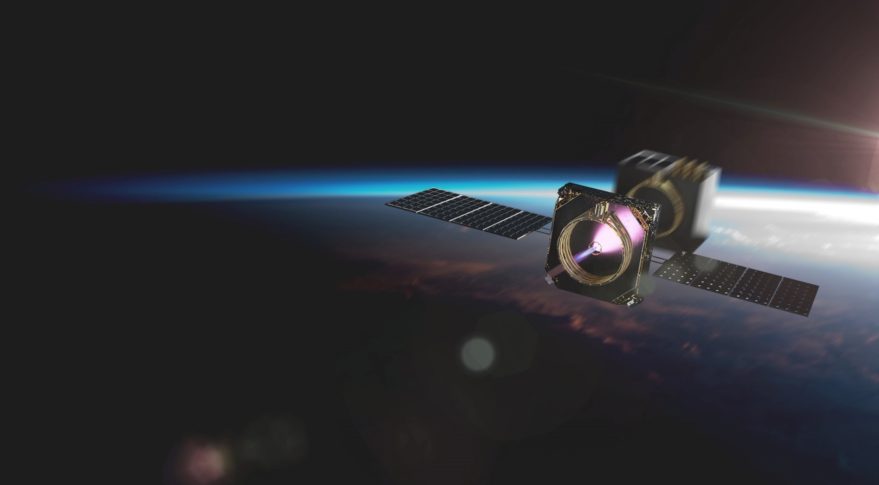

Stable Road also warned that a key technology for Momentus’s Vigoride and future tugs remains unproven. The water plasma thruster system used to propel the tugs “is still in the process of being developed and has not been fully tested or validated in space and may never have the capabilities or functionality in space that Momentus currently expects,” Stable Road stated in the SEC filing. Momentus claimed success in testing that propulsion system on a cubesat launched in 2019.

Other revisions to the merger agreement require Momentus to reimburse Stable Road for half of all costs associated with the merger, up to $1.5 million, incurred going forward, and indemnify Stable Road for any losses incurred should the deal not close. The companies have until Aug. 13 to close the deal after Stable Road shareholders narrowly approved a three-month extension in May.

-

Latest

Rocket Lab launches Electron in test of booster recovery

Rocket Lab launches Electron in test of booster recoveryRocket Lab launched its Electron rocket Nov. 19, placing nearly 30 smallsats in orbit while making its first attempt to recover the rocket’s first stage.The Electron lifted off from Rocket Lab’s Launc...

-

Next

Airbus and Safran Propose New Ariane 6 Design, Reorganization of Europe’s Rocket Industry

Airbus and Safran Propose New Ariane 6 Design, Reorganization of Europe’s Rocket IndustryEuropean space-hardware builders Airbus and Safran have proposed that the French and European space agencies scrap much of their previous 18 months’ work on a next-generation Ariane 6 rocket in favor...

Popular Articles

- Semiconductor Technologies

- Netflix’s next interactive show is Headspace's Mindfulness Experience

- Learn American Sign Language with 21 highly rated courses

- Keystone Light becomes a must-have wearable device in summer

- Ford received a pre-order for 100,000 F-150 Lightning in three weeks

- HASC to scrutinize Space Force budget: Satellites have to be ‘easier to defend’